Benefits for Our Connecticut NARFA Members

What Is NARFA?

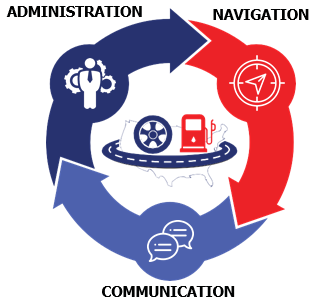

NARFA is the National Automotive Roads Fuel Association

The Association is a unique combination of automotive-related businesses and roads, fuel and related lines working together as a group. We have the strength of a large association and the qualities of a personalized business. We are also a tax-exempt organization, as we perform trade association duties.

- Regional Meetings

- Industry Advocacy

- Legislative Voice

- Compliance

- Educational Bulletins

- Administrative Support and Back-Office Functions

Exclusive Member Programs Not Available On The Open Market

Value of NARFA Membership

Because we represent hundreds of businesses across the United States, we have the buying power of a big group. This allows NARFA to obtain significant savings on products and services. These savings are then passed on to the membership in the form of lower rates for employee benefit programs and savings on the various products we offer.

You’ll enjoy:

- Buying power of a large group for health insurance, pharmacy, and much more

- Health insurance and other benefit programs designed exclusively for NARFA members

- Unparalleled administrative support

NARFA Programs Include

- Health Insurance PPO

- Health Savings Accounts

- Integrated Employee Assistance Program (EAP)

- Voluntary Benefits

- Voluntary Employee Beneficiary Association (VEBA)

- Comprehensive Administrative Services (ASO)

- Provides education and guidance on legislative and regulatory matters

- Assistance in wealth management, succession and estate planning, insurance review & placement

- Help establish a strong safety culture through consistent educational bulletins, news, updates, seminars & more

- Dental Benefits

- Short & Long Term Disability

- Integrated Group Life Insurance

- Exclusive Medical Plans

- Pharmacy Purchasing Cooperative

- P&C Vendor Access

NARFA Benefit Center

NARFA Programs Include

- Claim inquiries (denials, amount due, questions, etc.)

- ID card confirmation / resend for medical, dental, & vision

- If you have questions about behavioral and mental health support (EAP)

- Benefit coverage inquiries

- Review / obtain copies of benefit plan

- summaries

- Check your eligibility and networks

- Assistance with finding providers

Call For Your Medical Plan Questions Including:

- How much have I spent toward my deductible?

- What do I do if my claim is denied?

- What is my copay for this treatment?

- What happens if I don’t use all funds in my HSA?

- Will my insurance cover getting a second opinion?

The NARFA Benefit Center is Your Hub

NARFA Health Plans – Richer Coverage, Lower Premiums

Is Your Health Insurance Renewal Higher Than You Thought?

NARFA In Connecticut

This is your association; we are a community. NARFA is a group of businesses – just like yours – that has come together to create a bigger voice. We are a Trade Association established in 1929 with the goal of providing strength and stability for businesses in the automotive, roads, fuel and other related industries. We are your advocate for industry affairs, your voice in legislative issues, and your provider of programs exclusive to association.

EXCLUSIVE PROGRAMS NOT AVAILABLE THROUGH BROKERS

The Value of NARFA to Members

- PPOs with HMO pricing

- Exclusive programs for NARFA Connecticut members, not available on the open market

- Since 1995 our programs have returned approximately $30 million to member businesses

- Help with new business and retention

- Dedicated administrative support and dedicated customer support team

- Webinars featuring updates on the association, legislation, labor and employment law, finance, and much more.

- Network of industry leaders

- Resources for education

Multiple Health Plans Offered

NARFA is committed to giving you control and freedom of choice, and providing you with the right tools to know your costs and where to get the right care for the right price.

PPO Health Plans giving you one of the largest national networks and access to care when you need it without referrals. We offer plans Health Insurance in Connecticut for the automotive industry, auto repair associations, towing industry, trucker associations, fuel trade associations, and fleet industry. We also offer self-insured health insurance plans.

Health Savings Accounts (H.S.A.)

- S.A.contributions are tax-free

- Tax-free interest can be earned on the money in your account

- Withdrawals for qualified medical expenses are tax-free

- Preventative care, annual physicals, and age-appropriate exams covered at 100%

Reduced cost for primary care visits.

Reduced cost for generic prescription drugs

The NARFA Employee Assistance Program

A Confidential Resource Specifically for You

The NARFA Employee Assistance Program is a benefit for NARFA member businesses through the NARFA Insurance Trust Program, which assists you if you need help with issues regarding personal matters, such as work performance or challenges in your life. If you feel like there are challenges that are overtaking your life, this is the place to start to overcome those challenges

Confidentiality

No confidential information shared with an EAP can be released without your written consent. Exceptions include information in accordance with state laws when there is a serious risk of harm to self or others, elder and/or child abuse.

Privacy

Treatment by EAP counselors is covered under Federal HIPAA regulations. Modern Assistance takes every precaution to ensure your confidential information is protected.

Modern Assistance Services:

1:1 counseling

- On-demand; flexible scheduling

- Licensed Master clinicians

- No copay/cost; included in benefit package

- Available via telehealth, in-person, or via telephone

Case management

- Referrals to treatment facilities and outpatient providers

- Ongoing aftercare planning

Engagement:

- Confidential call to EAP

- “Walk in” for crisis situation

- Clinician determines appropriate next steps for employee

- Counseling

- Treatment program

- Release of information (ROI) can be signed when needed to update employer

NARFA Dental Program

A Confidential Resource Specifically for Connecticut Members

Businesses in the automotive, roads, and fuel industries have unique needs when it comes to dental coverage. That’s why NARFA has negotiated employee dental benefit plans tailored for you. The NARFA Dental Plans are designed to provide employees with maximum benefits, very little fine print, and complete freedom to use any dentist.

The NARFA Exchange and Purchasing Cooperative specializes in the dental coverage needs of small businesses: You can offer your employees a choice of multiple dental plans.

NARFA Voluntary Benefits and Life Insurance

NARFA strives to offer the best benefits for our membership, and our Voluntary Benefits programs offer great flexibility to our already rich benefits offerings. We designed our program with several things in mind:

- Employees want additional benefits

- They relieve financial pressure

- They are cost-effective

Life Insurance

NARFA has negotiated affordable group life insurance plans that ensure your employees’ families have the money they need for expenses that could result from the loss of a family provider.

If an individual is enrolled in the NARFA Medical Program $10,000 life insurance policy is included. The employer can also provide a group insurance $10,000 benefit for are benefit eligible.

The employee also has the option to buy their own individual policy for themselves, spouse, and dependents. NARFA has negotiated excellent rates for membership, and is always happy to review.

Policy reviews can uncover:

- Changes in life expectancy and medical history

- Insurance company changes

- Products offered in the market that may be a better fit

- Premium changes based on preventative care, risk level, and more

NARFA Short Term Disability Plan

The NARFA Short-Term Disability Program will help you and your eligible employees insure a portion of your/their income if you/they should become disabled.

Voluntary Short-Term Disability Insurance pays a flat dollar amount if a claimant cannot work because of a disabling illness or injury. Employees have the opportunity to purchase Voluntary Short-Term Disability Insurance in flat amounts not to exceed 60% of pre-disability earnings.

Once approved for coverage, benefits commence on the 15th day of the accident and the 22nd day of sickness and are designed to continue for a total period of 26 weeks (including elimination periods).

All your full-time employees can participate in this valuable program on an employee-pay-all basis. The Short Term Disability Program is treated as an employee-pay-all program; therefore, the benefit will be treated as “non-taxable”.

Short-term disability policy benefits and premiums are determined by annual salary range (does not include bonuses, commission & overtime).

NARFA Long Term Disability Plan

The NARFA Long-Term Disability Program will help you and your eligible employees insure a portion of your/their income if you/they should become disabled.

Voluntary Long-Term Disability Insurance pays up to 60% of the claimant’s base income if a claimant cannot work because of a disabling illness or injury.

Once approved for coverage, benefits commence once the 180 day elimination period has been met. Payments will continue for as long as the claimant remains disabled as defined by the policy, or until they reach their Social Security Normal Retirement Age, whichever is sooner.

For businesses in Connecticut, all of your full-time employees can participate in this valuable program on an employee-pay-all basis. The Long-Term Disability Program is treated as an employee-pay-all program; therefore, the benefit will be treated as “non-taxable”.

Long-term disability policy benefits are 60% of your base income and pricing is determined by age bands.

Helpful Links