Why should employers care about their experience modification (e-mod) factor? Without knowing it, some employers are being overcharged for workers’ compensation premium year after year. They have the misconception that the e-mod is out of their control, but the fact is that they can take steps to improve this factor and reduce costs.

Since e-mod is an indicator of an employers’ workers’ compensation loss history compared to its industry peers’, it’s used as a multiplier to increase or decrease premium.

Well-informed employers will obtain an annual review of the data used in their e-mod calculation and the actual promulgation of their e-mod. Equally valuable is a more comprehensive analysis that focuses on the controllable mod and the losses driving current costs. For some organizations, these opportunities can reduce premium by 5% to 15% in the first year and create potential future savings upwards of 30%.

Results like this not only can improve the overall financial health of an organization, but also increase its growth and profitability, as a lower e-mod improves the organization’s ability to bid on and win new contracts and projects.

Employers can take these crucial steps toward improving their e-mods and workers’ compensation programs:

1. Understand the E-Mod Factor and How It Impacts Premium

Many employers believe they can’t lower their e-mod because they (or their insurance agents) don’t understand how the factor works. E-mod is a component of workers’ compensation pricing models used by insurance companies and has a direct impact on premium.

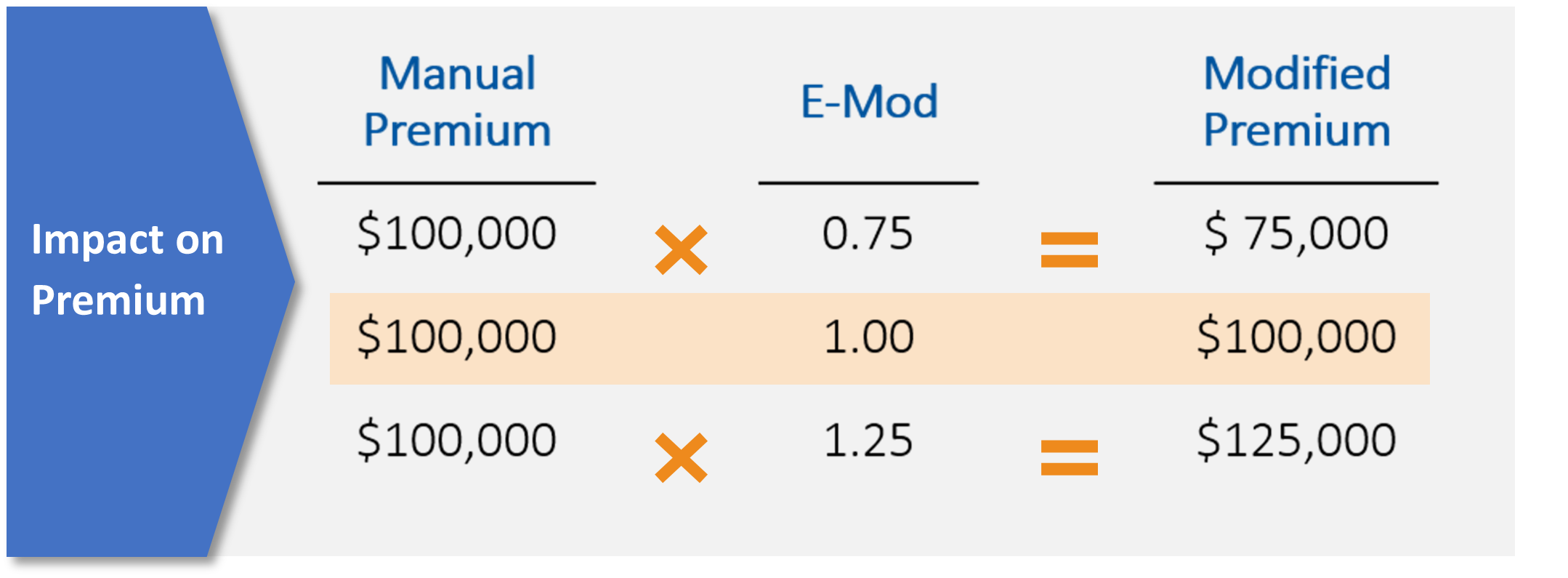

The e-mod is a measure of how your workers’ compensation loss experience compares to your peers’ — the calculation compares actual losses to “expected losses” of your peer group. The industry average is always expressed as an e-mod of 1.00, which doesn’t change the manual premium (the starting point for all calculations in the rating algorithm), as you can see in the chart above.

As the chart demonstrates, your e-mod has a direct correlation to the premiums you pay. As your e-mod improves or worsens as compared to the industry average, there’s a corresponding impact to your workers’ compensation costs. An e-mod of 1.25 leads to a 25% increase in premium, while an e-mod of 0.75 results in a 25% reduction in premium. Just as significantly, many large projects and government contracts require companies to have an experience modification rate of no more than 1.00.

2. Analyze Your Current E-Mod to Confirm Accuracy and Correct Errors in Premium

Because promulgation of the e-mod is complex, the process often results in errors and inflated premium. E-mods are calculated using losses and audited payrolls that are reported by the insurer to the states’ rating bureaus or advisory boards. Errors in the data used to promulgate the e-mod and the actual calculation of your e-mod can occur, impacting the e-mod and the amount of premium that you must pay. These key factors drive the calculation:

- Job classification — Are your class codes accurate? Changes in operations, staff and job responsibilities can result in miscoding errors and overpayment of workers’ compensation premium.

- Payroll — This may be erroneously overstated (e.g., overtime and bonus payroll, or certain portions of executive compensation).

- Claims — Are claims and reserves accurate? E-mod is calculated based on the last three years of claim history.

An error in any one of these areas can result in overpayment of premium. An effective analysis will review all data used to calculate the e-mod, correcting errors and ensuring that premiums reflect e-mod improvement.

3. Quantify Future E-Mod Improvement and Premium Savings

Following a review and confirmation of your e-mod’s accuracy, a more comprehensive analysis is critical for quantifying your future opportunity to further improve your e-mod. The analysis pivots from a retrospective review to a prospective analysis of your controllable e-mod, and to the future saving opportunity if you were to continue to drive down your e-mod.

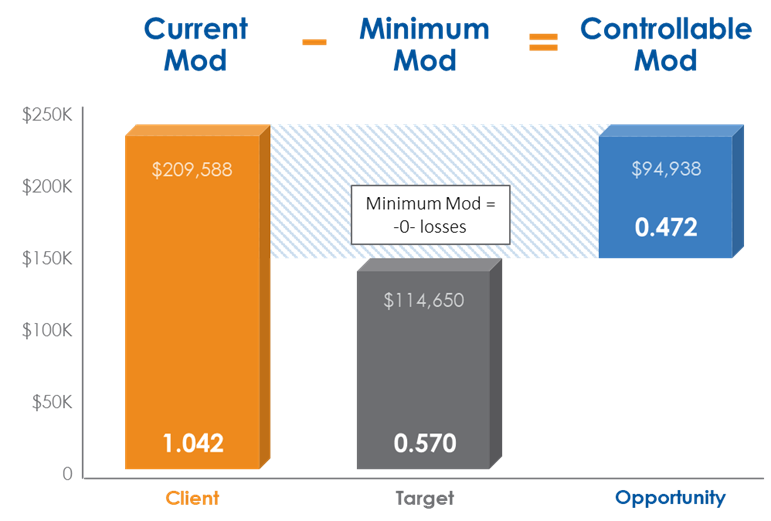

The controllable mod is the difference between the current mod and the minimum mod. These values are important because they highlight the savings that are possible by controlling losses with targeted risk management strategies.

4. Analyze Claims and Identify Loss Trends Driving Your Current E-Mod

Once the controllable mod is established, a detailed claims analysis will determine which claims and trends are driving the current e-mod and preventing continued savings. The analysis should focus on historical loss trends, such as the nature, cause and location of losses, with attention given to the impact these losses have on your experience modification factor and resulting workers’ compensation premium.

Recent Posts

The U.S. Department of Labor Announces Proposed Rule To Protect Indoor, Outdoor Workers From Extreme Heat

The U.S. Department of Labor has proposed a new rule aimed at protecting workers from extreme heat hazards. This initiative seeks to safeguard approximately 36 [...]

Supreme Court Overturns Chevron Deference: What It Means for Workplace Safety and Regulation

The landscape of federal regulation is set for a seismic shift following a recent Supreme Court decision. On June 28, in Loper Bright Enterprises, et [...]

Navigating the Compliance Maze: How NARFA Simplifies Employee Benefits for Automotive and Trade Industries

In today's complex regulatory environment, businesses in the automotive, roads, fuel, and related industries face unprecedented challenges in managing employee benefits. Recent studies show that [...]