There’s really no denying it: The Affordable Care Act (ACA), or Obamacare, is extremely controversial. It’s rocking the boat and sending shockwaves through our households and workplaces, and it even managed to put our Congress into a stalemate for over two weeks.

Still, open enrollment in the ACA’s Health Insurance Marketplace (or “exchange”) began over one month ago, so it would appear that for the foreseeable future, this program is here to stay. For some, this could mean potentially big gains, but this program is not without penalties for those who do not comply or fail to qualify for/obtain an exemption. So, it’s important to know where you stand in the matter.

In this article, we identify important ACA penalties and exemptions.

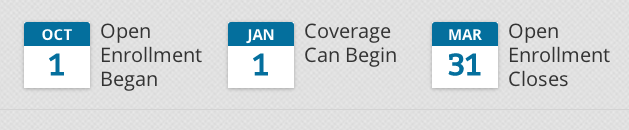

Important Dates

First, it is crucial that you recognize the timeline determined for enrolling in Obamacare:

Oct. 1, 2013 – Open enrollment began (access plans here or call 1-800-318-2596)

Jan. 1, 2014 – Most every American will be required to carry health insurance

Mar. 31, 2014 – Open enrollment closes and penalization begins

Penalties for Noncompliance

Should you fail to acquire health insurance or qualify for exemption by the close of open enrollment, expect the following tax penalties to be imposed for each of the following years per person:

2014 – 1% of your annual income (or $95, whichever is greater)

2015 – 2% of your annual income (or $325, whichever is greater)

2016 – 2.5% of your annual income (or $695, whichever is greater)

All penalties will be due to with annual federal tax returns, and after 2016, these figures will be adjusted in accordance to the cost of living. In 2014, it is also important to note that the payment for uninsured children will be $47.50 per child.

Exemptions from Penalties

Like any rule, there are exceptions, or in this case, exemptions. As outlined by Obamacare, exemptions will be granted for those who:

- Receive employer provided health care coverage

- Are uninsured for less than 3 months of the year

- Have a premium that would exceed 8% of their income

- Have an income below the filing threshold (less than 133% of federal poverty level)

- Qualified for Medicaid in state that does not recognize this

- Are in an Indian tribe

- Are not lawfully present in the U.S.

- Are an illegal immigrant

- Are incarcerated

- Qualify for religious reasons, such as being a member of recognized religious sect that has objections to other insurance, too, such as Social Security or Medicare

- Qualify for a hardship exemption, in other words, suffer a major life event – this includes homelessness, eviction within 6 months of your enrollment period, victimization of recent domestic violence, recently experiencing a flood, fire, or other substantial disaster, etc. (for a complete list of hardships, click here)

Remember, it is your responsibility to obtain health insurance coverage prior to March 31, 2014. If you neglect to abide, you must be prepared for the penalties you will incur.

For more helpful information on Obamacare, check out our blog, Obamacare – Taking a Deeper Look at Health Insurance Exchanges, or our other article, Obamacare – What Boomers Should Know Moving Forward. You can also visit our Health Care Reform page to learn more.

Recent Posts

The U.S. Department of Labor Announces Proposed Rule To Protect Indoor, Outdoor Workers From Extreme Heat

The U.S. Department of Labor has proposed a new rule aimed at protecting workers from extreme heat hazards. This initiative seeks to safeguard approximately 36 [...]

Supreme Court Overturns Chevron Deference: What It Means for Workplace Safety and Regulation

The landscape of federal regulation is set for a seismic shift following a recent Supreme Court decision. On June 28, in Loper Bright Enterprises, et [...]

Navigating the Compliance Maze: How NARFA Simplifies Employee Benefits for Automotive and Trade Industries

In today's complex regulatory environment, businesses in the automotive, roads, fuel, and related industries face unprecedented challenges in managing employee benefits. Recent studies show that [...]